Discover the top crypto exchanges with the lowest fees in 2025. Compare fees, supported cryptocurrencies, security, and user experience to find the perfect platform for your trading needs.

Table of Contents

Introduction

Cryptocurrency trading can be lucrative, but high fees can quickly eat into your profits. That’s why finding the best crypto exchanges for low fees is crucial. But with countless options available, it can be overwhelming to determine the best one. Fear not! We’ve done the research and compiled a list of the top crypto exchanges known for their low fees. Get ready to maximize your crypto gains!

Understanding Crypto Exchange Fees

- Explain different types of fees (trading, withdrawal, deposit, etc.)

- Discuss how fee structures work (flat rate, tiered, maker/taker)

- Importance of considering hidden fees

Before diving into specific exchanges, it’s crucial to understand the different types of fees you might encounter:

- Trading fees: These are the most common fees, charged for buying or selling cryptocurrencies. They can vary based on the trading volume, the type of order (market, limit, etc.), and the exchange’s fee structure.

- Withdrawal fees: Whenever you transfer your cryptocurrencies off the exchange to a personal wallet, you’ll likely incur a withdrawal fee. These fees vary by cryptocurrency and exchange.

- Deposit fees: While less common, some exchanges charge fees for depositing funds into your account. This is usually only the case for fiat currency deposits.

- Other fees: Some exchanges may have additional fees, such as inactivity fees or fees for specific services like margin trading or staking.

Fee structures can also vary. Common types include:

- Flat rate: A fixed fee for every trade, regardless of the amount.

- Tiered fees: Fees decrease as your trading volume increases.

- Maker/taker fees: Rewards market makers (those who add liquidity) with lower fees and charges higher fees to market takers (those who remove liquidity).

It’s essential to look beyond the advertised fees. Some exchanges have hidden fees or complex fee structures that can add up over time. Always read the fine print and consider the total cost of ownership when choosing an exchange.

Best Crypto Exchanges for Low Fees

- Kraken: Highlight low trading fees, advanced trading features, and security measures.

- Binance: Discuss tiered fee structure, wide range of cryptocurrencies, and user-friendly interface.

- Coinbase: Emphasize user-friendliness, security, and educational resources, while mentioning fees.

- Crypto.com: Focus on low fees for cardholders, staking rewards, and the Crypto.com Visa Card.

- Gemini: Highlight security features, regulated platform, and competitive fee structure.

Finding the perfect balance between low fees and a great trading experience isn’t always easy. Here’s a breakdown of some top contenders known for their fee-friendly structures:

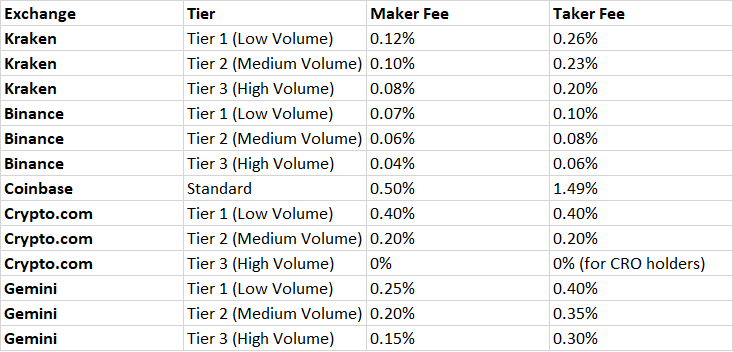

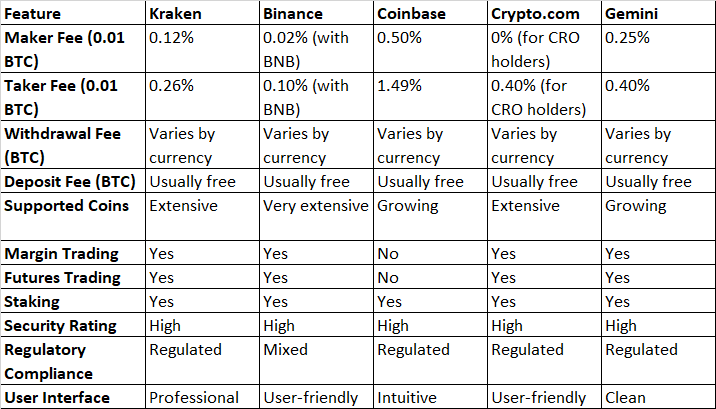

- Kraken: This veteran exchange shines with consistently low trading fees. They boast a tiered fee structure that rewards high-volume traders with even lower rates. Kraken caters to experienced users with advanced trading features like margin trading and staking. Plus, their robust security measures make them a favorite for security-conscious investors.

- Binance: When it comes to sheer variety, Binance takes the crown. They offer a massive selection of cryptocurrencies, making them a one-stop shop for diverse investment options. Their tiered fee structure incentivizes frequent trading and reduces costs as your trading volume increases. Binance also boasts a user-friendly interface, making it a breeze to navigate even for beginners (though keep in mind the advanced features might be overwhelming for some).

- Coinbase: This user-friendly platform caters to beginners with its intuitive interface and wealth of educational resources. While their fees might be slightly higher than some competitors, Coinbase makes up for it with top-notch security and a regulated platform. They offer a straightforward fee structure, making it easy to calculate costs upfront.

- Crypto.com: If you’re looking for a platform that rewards loyalty, Crypto.com might be your match. Their fee structure offers significant discounts for Crypto.com Visa Card holders. They also incentivize holding crypto through attractive staking rewards. Overall, Crypto.com provides a compelling package for those seeking a combination of low fees and additional benefits.

- Gemini: Security is paramount at Gemini, a regulated exchange known for its stringent measures. They offer a competitive fee structure with a maker-taker model that rewards users who add liquidity to the market. While their selection of cryptocurrencies might be smaller compared to some giants, Gemini prioritizes security and stability for a smooth trading experience.

Factors to Consider When Choosing a Crypto Exchange

- Fee structure

- Supported cryptocurrencies

- Security measures

- User interface and experience

- Customer support

- Additional features (staking, lending, etc.)

Selecting the right crypto exchange is a crucial step in your crypto journey. Here are some key factors to consider:

- Fee structure: As discussed, understanding the different types of fees and how they impact your overall costs is essential. Compare fee structures across different exchanges to find the most cost-effective option for your trading volume and preferences.

- Supported cryptocurrencies: Ensure the exchange offers the cryptocurrencies you’re interested in trading or investing. A wide range of options provides flexibility and potential for diversification.

- Security measures: Prioritize exchanges with robust security features like two-factor authentication, cold storage, and insurance for your assets. Protecting your funds is paramount in the crypto world.

- User interface and experience: A user-friendly platform enhances your trading experience. Look for intuitive designs, clear information, and easy-to-use tools.

- Customer support: Reliable and responsive customer support is crucial in case of issues or questions. Check the availability of different support channels (live chat, email, phone) and their response times.

- Additional features: Some exchanges offer extra features like staking, lending, or margin trading. Evaluate if these features align with your investment goals and risk tolerance.

By carefully considering these factors, you can select a crypto exchange that best suits your needs and preferences.

Tips for Minimizing Crypto Exchange Fees

- Take advantage of fee discounts (volume-based, token holding, etc.)

- Choose the right fee structure based on your trading habits

- Consider using limit orders instead of market orders

- Explore fee-free crypto transfers

Reducing your crypto exchange fees can significantly impact your overall profitability. Here are some practical tips:

- Take advantage of fee discounts: Many exchanges offer fee discounts based on trading volume, holding specific tokens, or using their native tokens. Explore these options to potentially reduce your costs.

- Choose the right fee structure: Different exchanges have varying fee structures. Select the one that aligns with your trading habits. For example, if you frequently place limit orders, a maker-taker fee structure might be beneficial.

- Consider using limit orders instead of market orders: Limit orders allow you to set a specific price for your trade, potentially saving you money compared to market orders, which execute immediately at the current market price.

- Explore fee-free crypto transfers: Some exchanges or wallets offer fee-free transfers, which can help you save on moving your cryptocurrencies between platforms.

By implementing these strategies, you can optimize your trading costs and maximize your profits.

Conclusion

Choosing the best crypto exchanges for low fees is crucial for maximizing your profits. By understanding different fee structures, comparing various platforms, and implementing cost-saving strategies, you can significantly reduce your trading expenses.

Remember, the best exchange for you depends on your specific needs and trading habits. Compare fees, supported cryptocurrencies, security features, user experience, and additional services to find the perfect match.

Start comparing exchanges now to unlock potential savings and enhance your overall trading experience.

| Feature | Kraken | Binance | Coinbase | Crypto.com | Gemini |

|---|---|---|---|---|---|

| Trading Fees | Low (0.00% – 0.26%) – tiered maker-taker model | Tiered (0.00% – 0.10%) with BNB discounts | Higher (up to 1.49% + spread) | Low for cardholders (0.40%) – higher for others | Competitive (up to 1.00%) – maker-taker model |

| Target Audience | Experienced Traders | All Levels (Beginners to Advanced) | Beginners & Casual Investors | Crypto Enthusiasts (Cardholders, Staking) | Security-Conscious Investors |

| Strengths | Low Fees, Advanced Features (Margin, Futures) | Wide Coin Selection, User-Friendly Interface | Easy to Use, Secure, Educational Resources | Low Fees for Cardholders, Staking Rewards, Visa | Regulated Platform, High Security, Competitive Fees |

| Considerations | Complex fee structure, Less user-friendly | Complex fee structure, Regulatory Issues (varies) | Higher Fees | Requires CRO investment for lowest fees | Limited coin selection compared to others |