Considering diving into the world of cryptocurrency trading? Bybit, a well-known exchange platform, offers a range of features for both beginners and experienced traders. This comprehensive review examines Bybit’s strengths and weaknesses and how it compares to other popular exchanges. Whether you are a seasoned crypto investor or just starting out, this review will help you decide if this platform is right for your cryptocurrency goals.

Table of Contents

What is Bybit?

Founded in 2018, Bybit is a cryptocurrency exchange that is quickly gaining recognition due to its user-friendly platform and focus on derivatives trading. While Bybit offers spot trading for buying and selling cryptocurrencies, the company’s main strength lies in its robust derivatives market, which caters to experienced investors looking for leverage and advanced trading strategies.

Features:

Bybit has a compelling set of features aimed at both novice and experienced crypto traders:

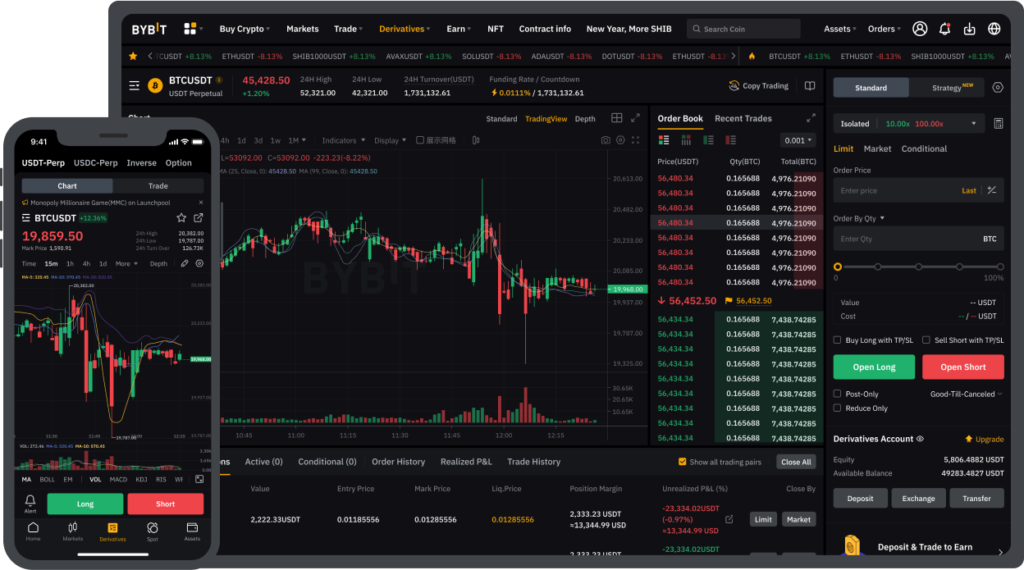

User-friendly interface: Bybit places great emphasis on user-friendliness with a clear and intuitive user interface. Whether you access the platform via your desktop or mobile app, navigating your portfolio, placing orders and tracking market movements is simple.

Highlight: This platform offers a dedicated mobile app with all the core features of the web platform, allowing you to manage your cryptocurrency investments on the go.

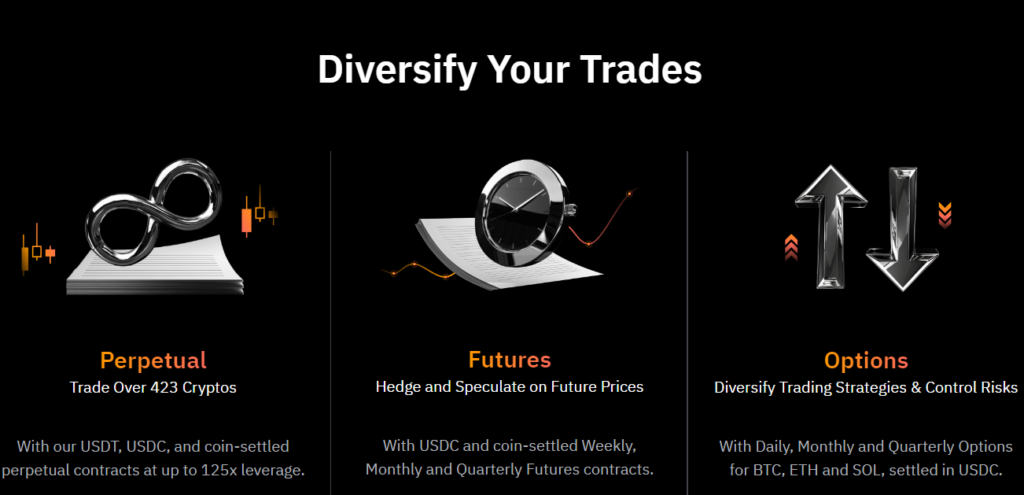

Advanced derivatives trading: Bybit shines with its range of derivatives. It offers a variety of derivative products, including:

- Perpetual contracts: These are leveraged contracts that replicate the underlying price of a cryptocurrency with no expiry date.

- Reverse perpetual contracts: These contracts offer the opportunity to profit from a fall in the price of a cryptocurrency, but with higher leverage.

Example: Imagine you are bearish on the short-term price of Bitcoin (BTC). With Bybit, you can enter into an inverse perpetual contract for BTC. If the price of BTC falls, you will make higher profits on your trade. However, if the price of BTC rises, your losses will be magnified. It is important to remember that trading derivatives carries significant risks and is only suitable for experienced investors who understand the potential consequences.

- Options trading: Bybit offers options contracts that allow investors to speculate on the future price movement of cryptocurrencies.

High leverage: Bybit offers competitive leverage options that allow you to amplify your potential returns (and risks) when trading derivatives. However, leverage can magnify both gains and losses, so use it wisely.

For example, with 10x leverage on a perpetual Bitcoin (BTC) contract, a 10 per cent price movement in BTC equates to a 100 per cent change in your account value. This can be very profitable if the market moves in your favour, but it can also lead to significant losses if the market moves against you.

Copy Trading: This platform offers a copy trading function that allows you to automatically copy the trades of experienced Bybit users. This can be a helpful tool for beginners who are still learning how to trade cryptocurrencies.

Pros & Cons:

Pros:

User-friendly interface suitable for beginners and experienced investors

Robust derivatives market with a wide range of derivative products

Competitive leverage options for higher returns (and risk)

Copy trading feature to mimic the strategies of experienced traders

Mobile app for managing cryptocurrencies on the go

Cons:

Limited selection of spot trading pairs compared to some other exchanges

Higher fees for smaller trading volumes

Focus on derivatives trading may not be ideal for all investors (derivatives carry significant risks)

Limited customer support options

Alternatives:

Here are some alternative cryptocurrency exchanges you should consider besides Bybit:

Kraken: An established exchange known for its user-friendly interface, security features and balance between spot and derivatives trading.

Binance: A leading cryptocurrency exchange with a wide range of spot trading pairs, advanced features and a strong focus on the Asian market.

Coinbase: Offers a user-friendly platform aimed primarily at beginners and casual investors, with a focus on security and compliance.

Gemini: Known for its security and compliance, Gemini is a popular choice for investors looking for a trustworthy platform.

KuCoin: Offers a wide selection of altcoins and a user-friendly interface that appeals to investors looking for diverse trading options.

As a reminder, this is just a short list of popular exchanges. There are many other platforms out there, each with their own strengths and weaknesses. It is important that you research thoroughly and compare several exchanges before making a decision.

Security and regulation:

Bybititit prioritises user security and has a robust security infrastructure that includes the following:

Two-Factor Authentication (2FA): This provides an extra layer of security by requiring a second verification code in addition to your password when you log in or perform transactions.

Secure storage solutions: This platform uses a combination of hot wallets (for easy access to frequently traded cryptocurrencies) and cold wallets (for secure offline storage of the majority of user funds).

Regular security audits: This platform undergoes regular security audits by independent companies to identify and fix potential vulnerabilities.

Although Bybit has stringent security measures in place, remember that the ultimate responsibility for protecting your account lies with you. Here are some additional security tips:

- Use a strong and unique password for your Bybit account.

- Enable 2FA and consider additional security features such as biometric authentication (if available).

- Beware of phishing scams and never share your login details with third parties.

Ease of use:

User-friendly interface: Bybitit emphasises a clear and intuitive user interface that makes it easy for both beginners and experienced traders to find their way around the platform. The layout of the platform is well structured and the most important functions and information are easily accessible.

Mobile app: Bybit offers a dedicated mobile app that allows users to manage their crypto investments on the go. The app replicates the core features of the web platform and provides a seamless experience for users who prefer to trade via their smartphone.

Educational resources: Bybit offers a variety of educational resources, including tutorials, guides and articles to help users understand the basics of cryptocurrency and trading. These resources are valuable for beginners who are new to the world of cryptocurrencies.

Customer Support:

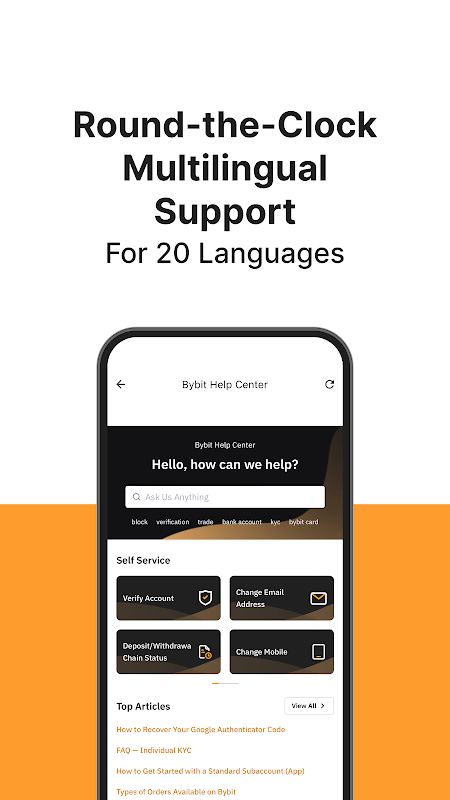

Bybit offers its users several ways to seek help:

Help Centre: The Bybit Help Centre offers a comprehensive knowledge base with articles on a variety of topics including account management, security, deposits, withdrawals and troubleshooting common issues. With this self-service resource, questions can often be resolved without the need for direct contact with customer support.

Live Chat: For immediate assistance, This platform offers a live chat feature. Here you can get in touch with customer support staff in real time to resolve urgent issues or questions.

Email support: If your enquiry requires a more detailed explanation or contains sensitive information, you can contact Bybit’s customer support team by email.

Social media: This platform maintains an active presence on social media platforms such as Twitter and Telegram where users can seek help or engage with the community.

Fees:

Bybit trading fees.

Bybit has a tiered fee structure, meaning the fees you pay depend on your trading volume or VIP level. The higher your trading volume or VIP level, the lower your fees.

- Fees for spot trading: For non-VIP users, the taker fee (for market orders) is 0.1%, while the maker fee (for limit orders) is 0.1%. VIP users benefit from significantly lower fees.

- Fees for open-ended contracts: Similar to spot trading, Bybit also charges maker and taker fees for open-ended contracts. The exact fees depend on your VIP level.

- Fees for futures contracts: This platform also charges fees for futures contracts. The fee structure is generally similar to perpetual contracts, with adjustments for different contract types.

- Fees for options contracts: This platform charges fees for options contracts, including fees for entering into, exercising and early cancellation of contracts. These fees vary by contract type and contract terms.

Note: This platform updates its fee structure regularly. The latest information on fees can be found on Bybit’s official website.

Bybit fees for deposits and withdrawals:

- Deposits: In general, there are no deposit fees for cryptocurrencies at Bybit. However, for deposits in fiat currencies, fees may apply depending on the payment method.

- Withdrawals: Bybit charges withdrawal fees for cryptocurrencies. The amount of the fees varies depending on the cryptocurrency and the withdrawal network used.

- Other fees

- Financing fees: Financing fees apply to open-ended contracts, i.e. periodic payments between long and short positions.

- Margin interest: If you use margin trading, you will incur interest costs on the borrowed funds.

How you can reduce fees with Bybit:

- Increase your trading volume: the higher your trading volume, the higher your VIP level, resulting in lower fees.

- Use maker orders: Maker orders usually have lower fees than taker orders.

- Take advantage of Bybit’s fee reductions: Take advantage of all special promotions and discounts offered by Bybit.

Conclusion:

Bybit offers both beginners and experienced cryptocurrency traders a convincing platform. Its user-friendly interface, advanced derivatives trading features and competitive fee structure make it an attractive option. However, when making your decision, also consider the limitations, such as the focus on derivatives and potential customer support issues.

Ultimately, the best cryptocurrency exchange is a matter of individual preference and investment goals. It is important that you research thoroughly and compare multiple platforms before making a final decision. Remember that the cryptocurrency market is dynamic and it is important to stay informed about the latest trends and developments.

By carefully evaluating your needs and exploring different options, you can choose the cryptocurrency exchange that best suits your investment strategy and risk tolerance.